Epay has established strong partnerships with renowned domestic banks and Alipay to offer comprehensive CNY exchange settlement solutions for cross-border merchants and overseas Chinese, covering B2B, C2C, and other transaction types.

epay

Countries Covered

Number of Users

Currencies Supported

Our Service

- CNY Settlement

- Global Collection

- Global Payments

CNY Settlement

Industry Solutions

For Overseas Chinese

Epay is the one-stop cross-border payment service provider for people overseas, who study, travel, trade, migrate and work abroad.

For Cross-border E-commerce

Epay provides you with suitable payment solutions. We assist you to solve payment difficulties, increase customer acquisition, and boost sales.

For Social Media Platforms

Your payees from different countries can receive money through a local bank or pick it up in cash with a favorable exchange rate and low costs.

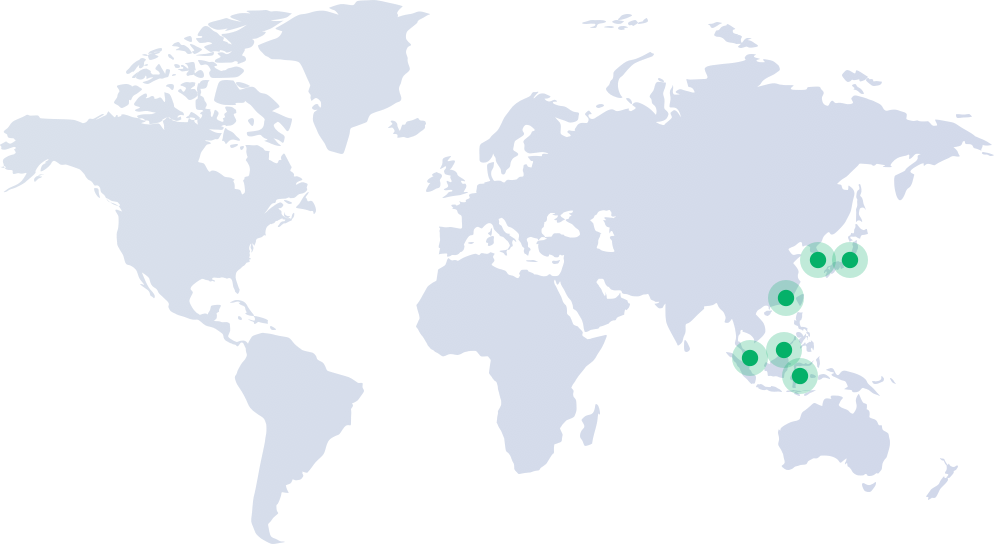

Epay Global Pay In

Asia

Americas

Europe

Africa

HongKong, China

Indonesia

Japan

Malaysia

Singapore

Korea

Thailand

Philippines

Vietnam

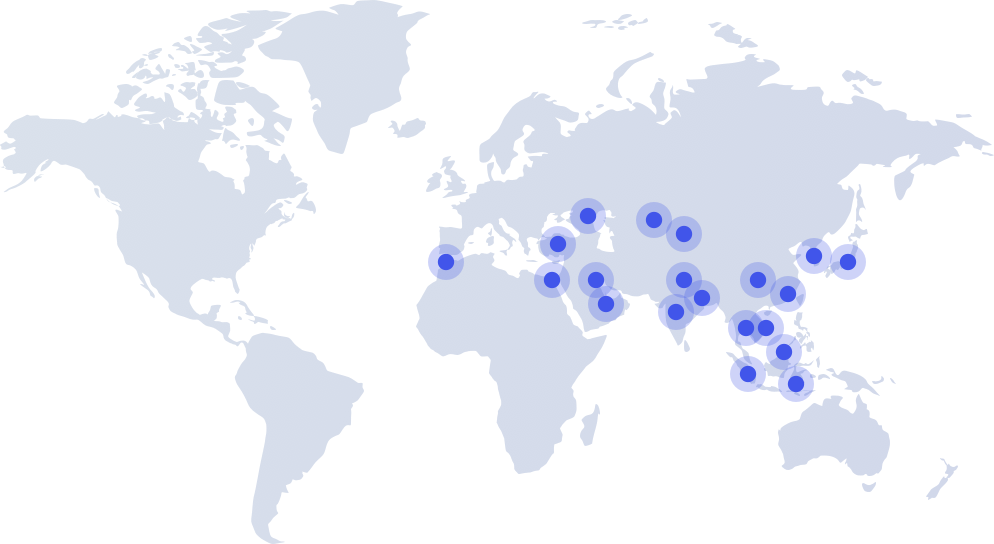

Epay Global Pay Out

Asia

Americas

Europe

Africa

Oceania

China

HongKong, China

Japan

Malaysia

Singapore

Korea

Thailand

Vietnam

Indonesia

Sri Lanka

Kuwait

Tajikistan

Jordan

India

Morocco

Turkey

Nepal

Bangladesh

United Arab Emirates

Pakistan

Georgia

Azerbaijan

Qatar

Lebanon

Bahrain

Philippines

Uzbekistan

Explore More Solutions?

Please Chat with Our Business Team

Cooperative Partner

Business Cooperative

Media Cooperative